Capital Gains Tax started on the 20/09/1985

Indexation Method is before the 21/09/1999

Cost of Owning Asset can only be used before 21/08/1991

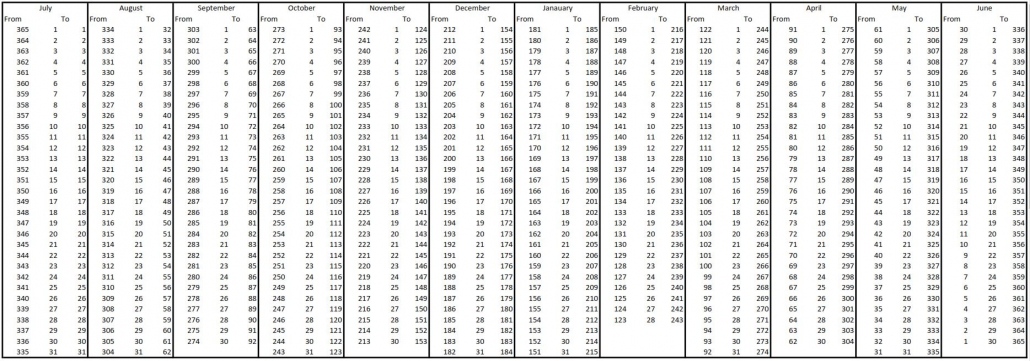

CPI Table = Sold year / Purchased year

$300 limit does not include claims for

- Car D1

- Overtime meals D5

- Award Transport payments D2

- Travel Allowance Expenses D2

D1 – To claim fuel receipts a log book must be kept for 12 weeks every 5 years

or capped at 5000km

D2 – Need all receipts and be able to demonstrate taxable use percentage

Medicare Levy – M1Y – Exclude any child whom maintenance is being paid

Medicare Levy Surcharge IT8 – Include any child whom maintenance is being paid

Full Time Defense Force gets full 2% levy @M1V or half if married to non full time defense forcer.

Adjusted RFBA = Exempt = x 0.53

Foreign Pension or annuity with UPP = Item 20 D = also complete D11

All capital gains foreign or otherwise goes at Item 18

Foreign Interest Paid is entered at D15

Item 24

Lump Sum E = Category 1

Balancing Adjustment on Assets = Category 1

Professional Income = Category 4

Jury Income = Category 4

Xero Tax

Cannot include a depreciation worksheet for PSI – this need to be manually calculated and entered at Item P1 or P10

You can create a depreciation schedule for D5 first and then click on Transfer and select ‘unlink depreciation item)

Item P8 on Business Schedule (can be negative number)

You need to split the amount at label Z into the following 3 fields.

This is then transferred to Item 15