BOOKKEEPING AND PAYROLL

Bookkeeping is a Vital Job in any Business

“Bookkeeping is the essential starting point of the accounting process. Only with accurate bookkeeping can meaningful accounting be done.”

Xero Bookkeeping

With the help of Xero and Xero add-ons, our bookkeeping services will help streamline, automate and dramatically improve your business processes.

We…

- Tidy your Xero file includes Chart of Accounts

- Review organisation, payroll and financial settings.

- Review current systems and processes.

- Assist with Xero Add-on integrations

- Assist with overdue tax lodgments.

- Reconcile payroll obligations.

- Provide meaningful and up to date reporting.

Regular Bookkeeping Package

Regular Bookkeeping Package suitable for:

- Business owners who are unsure or uncomfortable doing their own bookkeeping

- Business owners who are time poor and need to spend less time on administrative tasks and more time on connecting with clients, growing your brand and getting your products or services into the market.

- Business who are looking to save money by outsourcing rather then employing in-house.

- Businesses who do not have an office space to accommodate an in-house bookkeeper

Fixed Monthly Fees

- We understand that all business’ have different needs and requirements, we also realise and understand that not all bookkeepers can complete the same amount of work in the same amount of time, and this is why we have developed a Fixed Monthly Fee Plan to suit your business.

- This way you are guaranteed a service that you choose, at a cost that you agree with and can budget for, without any unexpected bookkeeping fees.

Rescue Bookkeeping Package

We offer a bookkeeping rescue package that will help bring order to the chaos and get your bookkeeping and business back on track.

Lets Get Organised!

- Does your Xero file need a good clean up?

- Are your Xero books a mess?

- Is your Balance Sheet and Profit and Loss showing as incorrect?

- Not sure what bills you have outstanding or who owes you money?

- Do you have a number of outstanding BAS’ and or Superannuation to lodge?

Off Site Bookkeeping How Does It Work

- Complete our online quote form

OR

- Contact us to request a quote

- Invite us into your Xero file. (click here for instructions)

- electronically via email to us or Hubdoc (a Xero add on)

- by taking a picture via Hubdoc on your smartphone (instructions will be provided)

- we can collect

- via mail

It really is that simple!

We…

- Enter all data into Xero, taking into consideration your reporting needs;

- Reconcile all accounts;

- Comply with all your external obligations – GST, PAYG, Single Touch Payroll, Superannuation, Workcover, Payroll Tax, etc;

- Prepare and lodge your BAS/IAS; and

- Process payroll.

- Manage debtors

- Plus much more – see our full list of bookkeeping services below

Frequently asked questions

Although the main bookkeeping task will be completed off-site, this does not mean that we are out-of-site. We want to be apart of your family, so enjoy visiting you at your premise, meeting your employees and seeing your business in operation.

(For Adelaide Business)

Although majority of the bookkeeping task will be completed off-site, we still prefer face-to-face where possible.

- You may prefer for us to come on site, so that you can meet us in person and to discuss your bookkeeping requirements;

- You may prefer for us to collect your documents on-site on a regular or sporadic basis (rather than scan, email or post);

- You may require or one of your staff may require some training which we can provide onsite or via Zoom; or

- You just have a question or concern and you would prefer to discuss this in person or face to face via Zoom…We are here for you!

We like to put a name to a face as much as you do. We also like to see your business in action, so although the main majority of bookkeeping will be done off site, we are just around the corner and at your disposal.

(For business that are located in other States)

We would like to Zoom with you where possible, so that you can also put a face to a name and if we are ever in your State we would love to drop by and say hello (shake a hand or bump an elbow) and see your business in action.

Bookkeeping is a vital job in any business. It involves the retrieving, collating, recording, storing, analysing and interpreting of all financial data for a business and give you a useful insight to the financial health of your business.

Bookkeeping occurs for three reasons:

- So that a business owner has up-to-date and accurate financial figures to be able to make strategic business decisions.

- So the business can easy remain compliant with the Australian Tax Office as well as other governmental agencies.

- So that an Accountant has a set of complete and clear set of financials to work from to provide stategic, legal and tax management services in a timely manner.

Xero is a world leading, cloud-based accounting software platform.

Being cloud-based means that business owners, bookkeepers and accountants can all work together in real time, by logging in online anytime and anywhere with a computer, smart phone or tablet.

There are also many other cloud-based programs that integrate with Xero which can help improve the management of your business dramatically.

Hubdoc is a document management software for you bills and statements. You can send bills and statements directly from you Hubdoc account from your phone or email and it is syncs directly with Xero.

The Balance Sheet is the most vital part of your business but often gets overlooked.

If your Balance Sheet is not correct, than your Profit and Loss isn’t showing its true figures….. and how can you run a successful business if your figures are incorrect?

A great bookkeeper knows that all Balance Sheet items need to be justifiable. So many errors can be hidden in the Balance Sheet and if your bookkeeper is inexperienced, they could possibly cost you money in the long run.

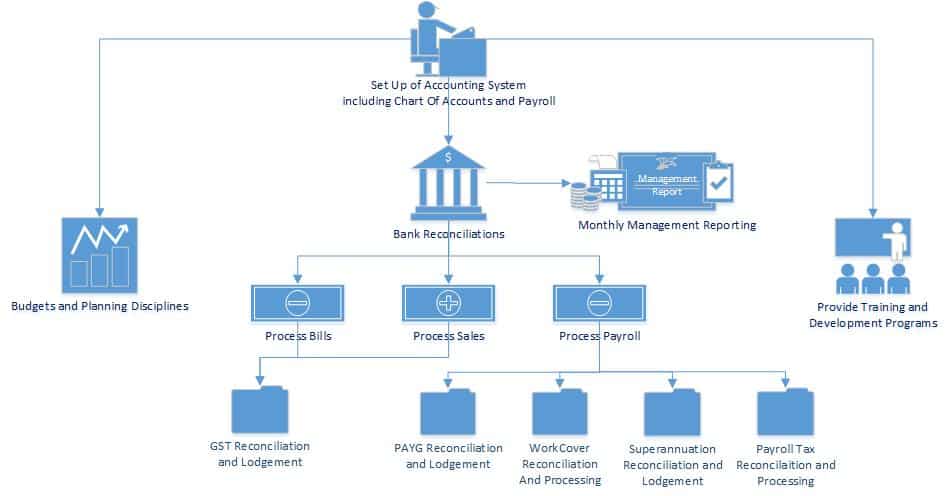

Services Include

- Customise dashboard

- Review organisation settings

- Review financial settings

- Customise chart of accounts

- Manage contacts

- Template customisation

- Enter sales and customer payments

- Automate debt collection

- Enter purchases

- Preparation of supplier batch payments

- Prepare bank reconciliation reports

- Prepare management reports

- Prepare payroll

- Reconcile and lodge super

- Workcover returns

- Payroll tax

- IAS Preparation & Lodgement

- BAS Preparation & Lodgement

If you do not have Xero for your business but are interested in this service or if you would like more information regarding Xero, please don’t hesitate to contact us. We can help you register and set up your Xero file to suit your business needs.

A skilled and compliant bookkeeper should have knowledge of debits and credits and an understanding of financial accounting, which includes the ‘balance sheet’ and ‘profit and loss’ and they should be able to perform the below list of duties that will help keep your business running smoothly:

Recording Daily Transactions

- keep track of all you daily transaction (receipts, invoices and other transaction details)

- record the information in accounting software using proper accounting methods

- reconcile all bank accounts, credit cards and petty cash

- reconcile other balance sheet accounts

- organise quotes to ensure best price for service

- preparing invoices and sending them to clients

- debt collection – actively pursue customers and clients for payment to help your cash flow

- work with you to make sense of the numbers, for example assigning costs to specific clients.

Software

- highly skilled in using accounting software – setup, installation and customisation

- add-on solutions to streamline your business workflow, more info

Advisors

- chart of accounts – the back bone of your accounting file – creation or modification to your reporting requirements

- keeping an eye on cashflow – one of the most important tasks for a bookkeeper is making sure the company doesn’t run out of day-to-day money.

- preparing the books for the accountant – trial balance, balance sheet, profit and loss, assets purchased, loans acquired.

- provide management reporting including divisional reporting if required

- development of annual budgets

- Payroll and Employment Services

- wages – setup and process

- single touch payroll reporting

- superannuation compliance

- workcover compliance

- payroll tax compliance

- end-of-year payment summaries (group certificates / income statements)

Other Services

- bookkeeping rescue work, tidying up mistakes made by inexperienced staff

training for small business on using accounting software. - offer day-to-day support for small business owners.

BAS Agent Services

- preparation and lodgement of Business Activity Statement (BAS) – GST and PAYG reporting

- preparation and lodgement of Income Activity Statement (IAS) – PAYG reporting

In summary, a good bookkeeper is your partner in keeping things running smoothly within your business. They allow you to concentrate on running your business and they are an extra pair of eyes watching your cash flow.