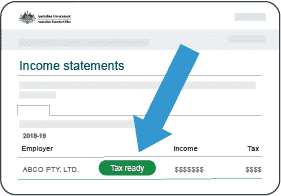

Your employer payment summary information is available at the end of the financial year in your ATO online services account through myGov and will be called an ‘income statement’.

It’s important to wait until your employer finalises your income statement to make it ‘tax ready’ before we can lodge your tax return. Most employers have until 31 July to check their employee’s income statement and finalise it for the year.

If we lodge your tax return and your income statement is not ‘tax ready’, your employer might make changes, and you/we may need to lodge an amendment. In some cases, additional tax and interest may be payable to the ATO.

To create a myGov account visit my.gov.au